Bitcoin Price Trajectory: 2025-2040 Comprehensive Forecast Analysis

#BTC

- Technical indicators show Bitcoin trading below key moving averages but with potential support at Bollinger Band lower levels

- Market sentiment reflects extreme fear historically associated with buying opportunities despite short-term volatility

- Long-term price trajectory remains bullish driven by halving cycles, institutional adoption, and increasing scarcity

BTC Price Prediction

Technical Analysis: Bitcoin Shows Mixed Signals Amid Current Volatility

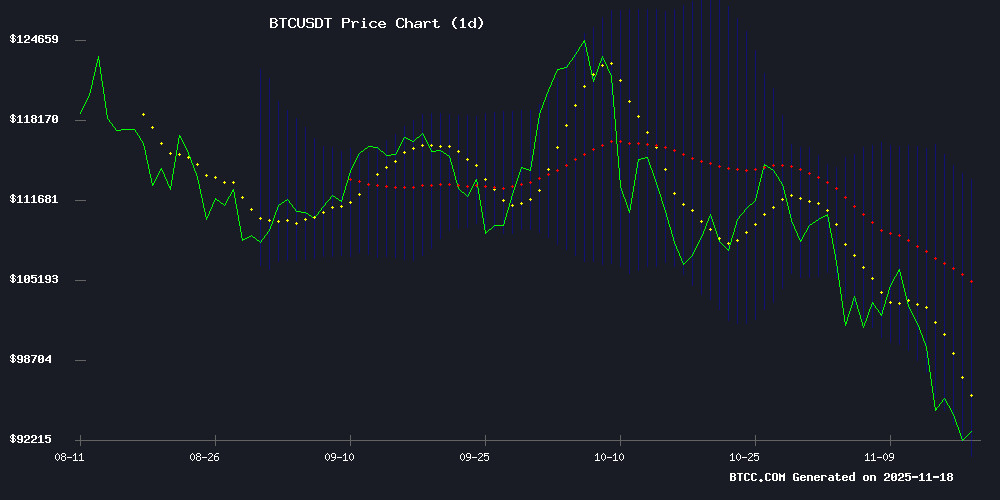

According to BTCC financial analyst Sophia, Bitcoin's current technical indicators present a complex picture. Trading at $93,503.39, BTC sits below its 20-day moving average of $102,140.03, indicating potential short-term weakness. However, the MACD reading of 6,148.91 above the signal line suggests some bullish momentum remains. The Bollinger Bands position Bitcoin near the lower band at $91,026.17, which could act as support. Sophia notes that a sustained break above the middle band at $102,140.03 would signal renewed bullish momentum.

Market Sentiment: Extreme Fear Dominates Bitcoin Landscape

BTCC financial analyst Sophia observes that current market sentiment reflects extreme fear levels, historically associated with potential buying opportunities. The combination of Mt. Gox's $936 million bitcoin movement after eight months of inactivity and NVIDIA's earnings impact on AI-related crypto assets has created significant uncertainty. However, Sophia highlights that El Salvador's continued Bitcoin accumulation and Adam Back's dismissal of quantum computing threats provide counterbalancing factors. The '5% era' as mining approaches supply cap suggests we're entering a new phase of Bitcoin's maturation.

Factors Influencing BTC's Price

Bitcoin Enters '5% Era' as Mining Nears Supply Cap

Bitcoin crossed a pivotal threshold on November 17, with 19.95 million coins mined—marking 95% completion of its 21 million supply cap. Only 1.05 million BTC remain to be extracted over the next 115 years, entering what miners call the '5% Era.'

The milestone validates Bitcoin's scarcity narrative that has attracted institutional investors, yet presents operational challenges for miners. Block rewards have decayed from 50 BTC at launch to just 3.125 BTC post-April 2024 halving, compressing profit margins.

'This isn't the endgame—it's the hardest phase,' remarked a mining executive, noting the geometric reduction in rewards will test operational efficiency. The network's monetary policy remains immutable: 21 million coins, no more, no less.

How to Mine Bitcoin Automatically in 2025: 5 Best Cloud Mining Tools for Profitable Crypto Investments

In 2025, Bitcoin mining faces heightened challenges—soaring global hash rates, volatile electricity costs, and regulatory scrutiny. Cloud mining emerges as a compelling alternative, offering hash-power rental without hardware management. Swiss-based AutoHash leads the pack with AI-optimized allocations and renewable energy integration.

Key considerations include withdrawal thresholds, contract terms, and performance transparency. The shift to cloud solutions reflects broader industry trends: efficiency, scalability, and jurisdictional arbitrage. Investors must weigh ROI potential against counterparty risks in this rapidly evolving sector.

Bitcoin Crash and NVIDIA Earnings Jolt Markets as AI Hype Falters

Global markets opened the week under significant pressure, with US stock futures declining and major indexes posting their steepest losses in months. The Dow Jones Industrial Average slid more than 550 points, while the S&P 500 and Nasdaq each dropped nearly 1%. Investor sentiment has shifted markedly from the exuberance that drove months of gains fueled by artificial intelligence hype and mega-cap tech stocks like NVIDIA. Valuations appear stretched, prompting a risk-off approach.

Bitcoin's sharp decline has exacerbated market anxiety. The cryptocurrency has fallen more than 25% since October, recently dipping below $90,000 and erasing all its year-to-date gains. This triggered cascading sell-offs across Asian and European markets. Crypto's highly leveraged nature means price drops often force investors to liquidate other assets, creating a feedback loop that spills into equities.

Bitcoin Slump Deepens as Small-Cap Cryptos Sink to Four-Year Lows

Global crypto markets face intensified selling pressure as Bitcoin's sharp decline below $94,000 triggers broad-based weakness. The benchmark cryptocurrency has erased nearly all its year-to-date gains, dragging smaller tokens to levels unseen since 2020.

ETF outflows compound the downturn as fading rate-cut expectations dampen risk appetite. Trading volumes contract across major exchanges while analysts debate whether current conditions mirror 2022's crypto winter or present a buying opportunity.

Market structure appears fragile with thin liquidity exacerbating volatility. The October leverage wipeout removed billions in speculative positions, leaving few buyers to stabilize prices. Yet some observers note fundamental differences from previous bear markets, suggesting long-term recovery potential remains intact.

Extreme Fear Hits Bitcoin While El Salvador Adds More BTC: Is a Recovery Ahead?

Bitcoin's price plunged below $90,000 as market sentiment hit extreme fear levels, with the Crypto Fear & Greed Index dropping to 15. Despite the bearish backdrop, El Salvador aggressively accumulated an additional 1,098 BTC this week, bringing its total holdings to 7,474 BTC—a $685 million bet against prevailing pessimism.

Market uncertainty intensified as defunct exchange Mt. Gox moved 10,423 BTC ($936 million) after eight months of dormancy. Technical indicators suggest further downside risk, with $83,000 looming as a critical support level if current prices falter.

The divergence between institutional accumulation and retail panic underscores Bitcoin's volatile maturation phase. El Salvador's continued purchases contrast sharply with Mt. Gox creditor distributions, creating competing forces in a market already grappling with macroeconomic headwinds.

Mt. Gox Moves $936 Million in Bitcoin After Eight Months of Inactivity

Mt. Gox has transferred 10,422 Bitcoin, valued at approximately $936 million, marking its first major movement in eight months. The defunct exchange's wallet activity resumed amid a volatile market, sparking speculation about potential market impacts.

Analysts suggest the transfer likely represents internal storage reorganization rather than preparatory selling. Arkham Intelligence confirmed the single-transaction move to a new wallet, with no subsequent dispersals detected.

The exchange retains 34,689 BTC ($3.12 billion) in its reserves. Market participants continue monitoring for signs of creditor repayments, which could introduce selling pressure if distributed to claimants.

Bitcoin Drops Below $91K as Investors Pivot to Bitcoin Hyper

Bitcoin's sudden breakdown below $91,000 has forced traders to reconsider where real opportunity lies. The leading cryptocurrency, once confidently pushing toward new highs, is now slipping into a structural downturn. This decline marks its lowest level in seven months and its most aggressive drop since October's peak at $126,000.

The wipeout has erased nearly all year-to-date gains and pushed market cap losses past $600 billion, intensifying concerns over liquidity outflows. Analysts describe the drop as a decisive failure of the previously identified $98,000 accumulation zone, which held as a psychological foundation for two weeks before yesterday's fall invalidated the structure.

With volatility accelerating and whale wallets rotating out of BTC, Bitcoin Hyper may be emerging as the best crypto to buy now for traders seeking yield, structure, and early-stage upside. Traders now point to a broader consolidation band between $82K and $88K, though downside pressure continues to mount.

Bitcoin Sentiment Hits Extreme Fear Levels Matching Historic Market Crashes

The Crypto Fear & Greed Index has plunged to 10 out of 100, a level rarely seen outside of major market crises. This reading mirrors the depths of March 2020's COVID crash, the post-FTX collapse in late 2022, and February's market turmoil. The index, originally adapted from CNN's stock market indicator by Alternative.me, aggregates six market metrics into a single daily score.

Volatility accounts for 25% of the calculation, measuring current drawdowns against 30- to 90-day averages. Market momentum and volume contribute another quarter, tracking buyer exhaustion or aggression. Social media buzz, search trends, Bitcoin dominance, and investor surveys complete the picture.

Multiple platforms including CoinMarketCap, CoinStats, and CoinGlass confirm the 'Extreme Fear' reading. Historically, such extreme sentiment often precedes market rebounds as panicked selling exhausts itself. The index serves as a contrarian indicator - when fear becomes this pervasive, it frequently signals an impending reversal rather than continued decline.

Bitcoin Price Prediction: Is The 2025 Crypto Bear Market Here?

Bitcoin's price struggles intensify as BTC breaches the $90,000 support level, marking a 30% decline from its recent all-time high of $126,296. The sustained four-week downtrend has sparked fears of an impending 2025 crypto bear market. Over $700 million in liquidations occurred within 24 hours, exacerbating trader anxiety.

Year-to-date gains have evaporated, with BTC now down 0.50% in 2025. Retail investor confidence has plummeted, institutional inflows have stalled, and Bitcoin ETFs face persistent outflows. Analysts attribute the sell-off to macro-economic pressures and large-scale holder liquidations.

Despite the turmoil, long-term proponents maintain Bitcoin's value proposition as an inflation hedge remains intact. Notably, Bitcoin Hyper's $27.8 million presale success highlights ongoing innovation within the ecosystem. MicroStrategy continues accumulating BTC, undeterred by market conditions.

Strategy Doubles Down on Bitcoin Accumulation Amid Market Volatility

Michael Saylor's Strategy has executed its largest Bitcoin purchase in months, acquiring 8,178 BTC for $835 million despite an 11% price drop. The move signals unwavering institutional conviction as the company's treasury swells to 649,870 BTC—solidifying its position as the world's largest corporate Bitcoin holder.

The purchase marks a dramatic acceleration from recent weekly acquisitions of 400-500 BTC. Saylor remains undeterred by criticism from gold advocates like Peter Schiff, even as MSTR shares fell 16% alongside BTC's decline to the $90,000 range. Market volatility appears to be fueling rather than stifling Strategy's accumulation strategy.

Quantum Danger To Bitcoin Overhyped, Says Adam Back

Adam Back, CEO of Blockstream and a prominent figure in the cypherpunk movement, dismisses the near-term threat of quantum computing to Bitcoin. He argues that the risk is overstated, with a timeline of 20 to 40 years before quantum machines could potentially break SHA-256 encryption.

Certified post-quantum solutions already exist and can be integrated into Bitcoin's protocol if needed. The current generation of quantum computers lacks the necessary power, with an estimated requirement of 8,000 logical qubits to threaten Bitcoin's cryptography—far beyond today's noisy and limited systems.

Back's reassurances come amid growing speculation about quantum vulnerabilities. His technical and strategic perspective shifts the debate from apocalyptic scenarios to pragmatic readiness, emphasizing Bitcoin's resilience in the face of evolving threats.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market fundamentals, BTCC financial analyst Sophia provides these long-term projections:

| Year | Price Range | Key Drivers |

|---|---|---|

| 2025 | $85,000 - $120,000 | Halving effects, ETF adoption, regulatory clarity |

| 2030 | $250,000 - $500,000 | Global adoption, institutional investment, scarcity premium |

| 2035 | $800,000 - $1,500,000 | Network effects, store-of-value status, technological maturity |

| 2040 | $2,000,000+ | Full monetary digitization, hedge against traditional systems |

Sophia emphasizes that these projections assume continued adoption and no catastrophic regulatory or technological disruptions. Current extreme fear sentiment often precedes significant rallies, making accumulation strategies potentially rewarding for long-term investors.